Small Cap Growth Strategy

Our Philosophy

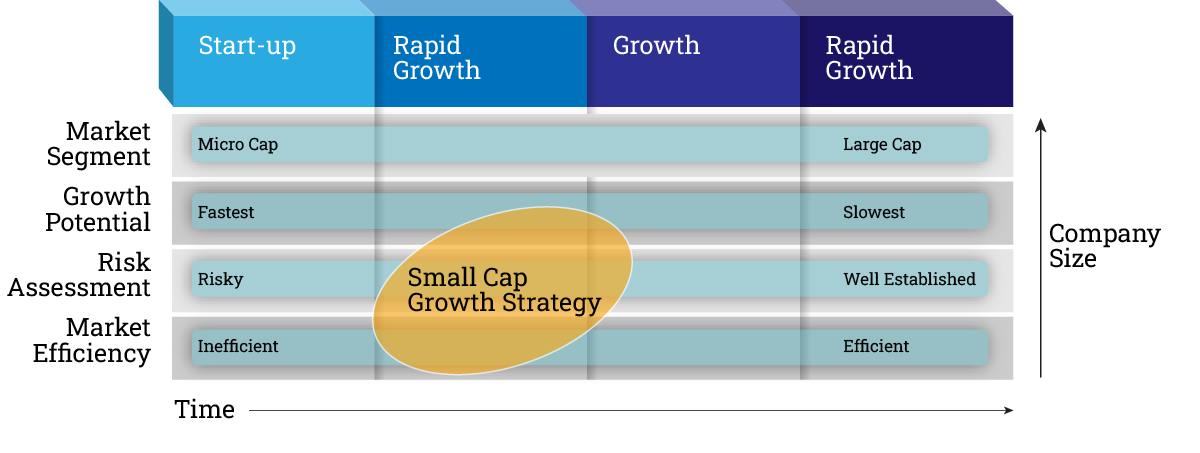

Positioned for Small Cap Upside

This diversified strategy seeks long term growth of capital by investing primarily in common stock of U.S. companies with market capitalizations that are less than the largest company in the Russell 2000® Growth Index at the time of investment.

Small cap issuers are often emerging growth companies that develop products and services, exploit new opportunities or possess a unique advantage over competitors. By investing in these companies during the early stages, there is potential for investors to realize significant returns.

Even more importantly, small cap stocks can be a complement to an overall portfolio, offering diversification benefits including the potential to reduce capitalization concentration risk. Of course, small cap investing involves greater risk than investing in more established companies, and the prices of small cap stocks may be more volatile than those of large cap company stocks.

Engaging With Us

Engage with us for high-conviction small cap investment management, driven by disciplined research and a long-term, diversified growth strategy.

Fact Sheet

Commentary

Mutual Fund

Effective February 24, 2012, the Stephens Small Cap Growth Fund and Stephens Mid Cap Growth Fund were reorganized into the American Beacon Family of Funds. The new Funds were renamed as the American Beacon Stephens Small Cap Growth Fund and the American Beacon Stephens Mid-Cap Growth Fund. SIMG continues to manage the day-to-day portfolio as the sub-adviser to the American Beacon Stephens Funds.

For more information on the Funds, please contact an American Beacon Client Services Representative during regular business hours at (800) 658-5811 and select option 1, or visit American Beacon's website at www.americanbeaconfunds.com.