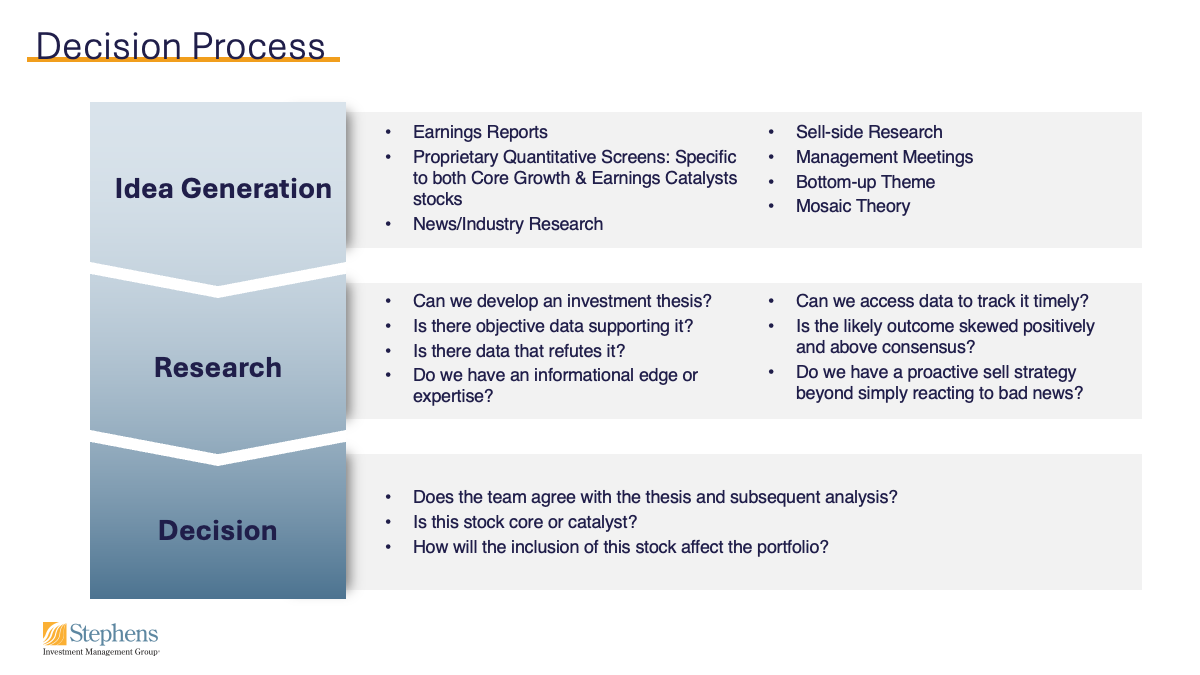

Our decision-making structure is designed to emphasize process over personality.

Every investment decision requires unanimous agreement from the team, reinforcing discipline and eliminating ego from the process. The portfolio typically holds 40-110 positions. Our repeatable, team-driven approach allows us to balance risk and return.

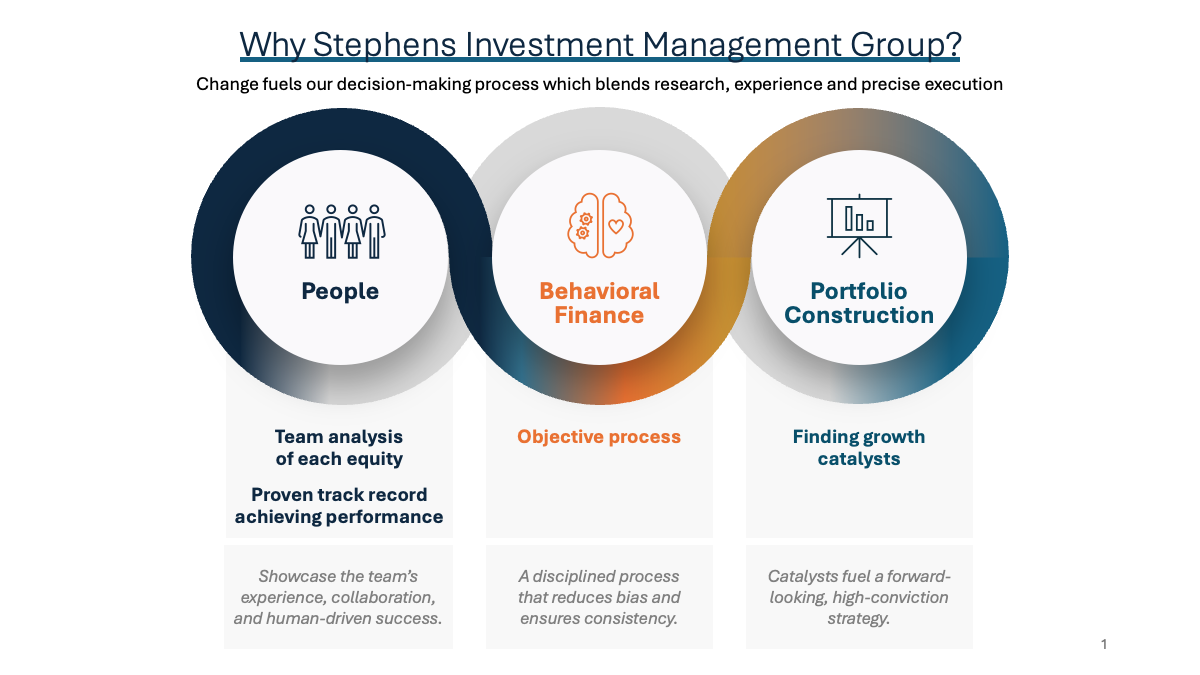

Reducing Emotion, Enhancing Long-Term Compounding

The team believes this approach reduces emotional decision-making and captures long-duration compounding more effectively.

Team and Decision-Making Structure

At Stephens Investment Management Group, all investment decisions are made unanimously through a disciplined, team-based process designed to eliminate ego and emotion. We build diversified portfolios of 40-110 positions to reduce single-stock risk and capitalize on market inefficiencies driven by transformational change.