The following contains a brief discussion of the equity markets from Chief Investment Officer and Senior Portfolio Manager, Ryan E. Crane.

MARKET OVERVIEW 1

It seemed as if there was a year’s worth of change packed into this quarter. Sentiment deteriorated quickly after the so-called “Liberation Day,” when the Trump administration unveiled tariffs which were much higher than expected. In some cases, international trade ground to a halt. Business deals and M&A transactions froze. Within weeks, we were in bear market territory.

President Trump paused some of the tariffs while negotiations were unfolding and the market quickly rebounded. By the end of the quarter, investors were focused on other things. Congress passed the One Big Beautiful Bill which should be stimulative in the near term. What some feared would be the beginnings of World War III with the US bombing key nuclear facilities in Iran, ended up being a quickly resolved matter to many pundits’ dismay.

Despite cool inflation data, the Fed cited concerns over tariff-fueled inflation and kept rates steady despite Mr. Trump’s protests. Long-term rates moved higher with the 30-year Treasury yield even briefly surpassing 5%. After tumbling over 11% in the first week of the quarter, the S&P 500® Index rallied to finish the period up 10.94%.

OUTLOOK

If my memory serves me, there was a time, maybe as little as twenty years ago, where people simply didn’t have opinions about some topics. The Internet, social media, and now AI have contributed in creating a society where everyone is an expert in whatever the topic du jour is. In April, everyone I know had a very strong opinion about tariffs and their impact on the economy. So many people were sure that the recent bombing of Iran’s nuclear facilities would lead to World War III. Somehow, when the news hit, their 10 minutes of reading social media posts made them experts on the subject. Think about the last five years, where everyone seemed to consider themselves an expert on epidemiology, vaccine safety, monetary policy, inflation, healthcare policy, immigration policy, tension in the Middle East, the Russia-Ukraine conflict, and so on.

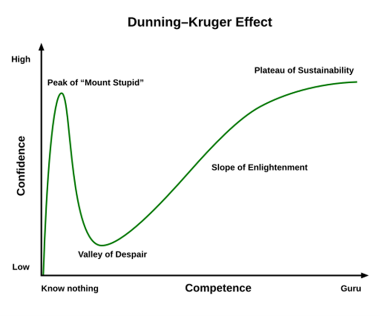

You may have heard of the Dunning-Kruger effect. It describes the situation when someone learns a little about a subject, and then they quickly overestimate their understanding and knowledge on that subject. Wikipedia has a great, self-explanatory chart:

This phenomenon (or cognitive bias) represents a serious lack of self-awareness, at least in the early phases of learning something new. My favorite and most relatable example of this is with new teenage drivers – they’re careful at first, and then after only about 3 months into having a driver’s license, they suddenly no longer need your advice or instruction. Their skills are developing slowly, but their confidence has skyrocketed. With how quickly the world is changing, it feels like we are all having to learn new things constantly. Beware! Many investors are falling into this trap, creating a less efficient and more volatile market – which is music to my ears. As Mark Twain once said, “It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.”

It should be no surprise that it takes a significant investment of time and energy to become an expert in any field. The funny thing is, that even the so-called experts have been flat-out wrong about so many things lately. You can’t really trust them either. My advice: be a skeptic, question everything.

In this most recent quarter, the market went into full-blown panic over tariffs – replete with headlines about bear markets and recessions, then somehow quickly moved on, and the market was back to making new highs. Comically, as I write this today, tariffs are back in the headlines, and the consternation and handwringing is back, too. I spent quite a bit of time writing about tariffs last quarter, and I absolutely stand behind and wish to reiterate my thoughts:

- Trump’s tariff negotiation process will be messy and unpleasant to watch, but might end up being effective.

- Tariffs, by themselves, are not inflationary. They might cause a one-time bump in the price level.

- The uncertainty and the bias around understanding the implications of tariffs will cause inefficiency and opportunity for level-headed, long-term investors.

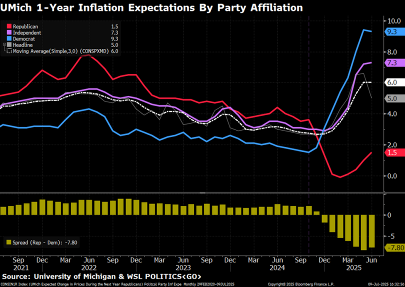

One of the big fears around tariffs is inflation. Last quarter I mentioned the inflation expectation data from the University of Michigan. It hasn’t changed all that much. Here’s the latest version.

If the data is to be trusted, then Democrats seemed convinced there will be catastrophic inflation and Republicans aren’t worried in the least. I can’t help but think this is just one example of an overwhelming case of the Dunning-Kruger effect combined with some subsequent confirmation bias fueled by algorithmic news delivery.

President Trump is a polarizing figure, maybe the most polarizing figure ever. No one has ever seen anything like it. Hugely polarizing. I’m quite certain that there are a significant number of people out there who perversely want to see a recession and a bear market, if only to justify their disdain for Trump.

I don’t want to assume that the Fed is biased against Trump in this way. But it is a curious thing that these are the people who completely failed to recognize that massive COVID stimulus could cause anything more than “transitory” inflation, cut rates aggressively last summer when inflation was still elevated, and now are arguing that these tariffs have a risk to cause persistent inflation. The media and the market have echoed Chair Powell’s concerns about tariff-induced persistent inflation. In an interview on Face the Nation, Treasury Secretary Scott Bessent fought back with some simple, but powerful logic:

When we were here in March, you said there was going to be big inflation. There hasn’t been any inflation. Actually, the inflation numbers are the best in four years. So why don’t we stop trying to say this could happen — wait and see what does happen.

I thought our Fed was supposed to be data-dependent?

If tariffs cause higher prices here, then the first thing that will happen is a slowdown. Consumers and firms are constrained by budgets. If prices of imported goods go up, then people will have less money to spend on other things, resulting in a reduction in aggregate demand. The second order effects and beyond might result in some inflation, but we haven’t even seen the first order effects yet. If there is risk of inflation (from tariffs), the path is on the labor side of things. If tariffs are sufficiently high that firms (both foreign and domestic) choose to build more means of production here in the US and hire more American workers, then you could have a wage-price spiral. The irony of this, of course, is that much of the motivation for tariffs is to rebuild a bigger manufacturing base (and the accompanying jobs) in the US. Some wage inflation is a feature, not a bug!

It will take quite some time for this risk to manifest itself. Like many economic effects, there are lags. It’s a little silly for people to be panicked in the near term about inflation. It’s perfectly justified to be worried about the price of certain foreign-made goods going up, but again that is not inflation, per se.

This is not to say that I’m not worried about inflation. I’ve been worried about inflation for over a decade. In my humble opinion, our greatest inflation risks stem from monetary policy and from government spending. My optimism for DOGE’s spending reductions has faded, and now with the passage of the One Big Beautiful Bill, it seems as if we are right back on track of an unsustainable process of ballooning government debt that will likely only be repaid by a debasement of the currency. Inflation hawks should be much more concerned about the OBBB than tariffs!

My conclusion today is back to what it was last year. It doesn’t seem that there is any real appetite to rein in government spending. Policy makers are suffering from the boy-who-cried-wolf syndrome with respect to debt and deficit levels: they’ve been told for years that they’re unsustainable, but their experience has been that there are no real problems…yet. We won’t be able to tax our way out of this problem. And so, the only alternative is the silent destroyer of savings that no one ever voted for and no one admits to causing – inflation.

I’ve written previously about how CPI calculations including hedonic adjustments and substitution in the basket of goods combined with a rapidly changing standard of living will understate headline inflation. I believe that where we will see more obvious examples of inflation is in asset inflation – the prices of real estate, gold, bitcoin, and stocks.

It’s a sad reality, but a nominally bullish one for equities.

As for the boy-who-cried-wolf problem, when the wolf actually shows up, I believe it will be in the form of long-term yields. There’s a lot going on in Treasury markets these days. Tariffs and changes in international trade seem to be reducing foreign demand for dollars and, thus, Treasuries. There’s been much debate about the dollar’s status as the world’s reserve currency. My take is that it still holds that claim, but not nearly as tightly as before.

There are two newer developments that may boost demand for Treasuries. First is the potential exemption of Treasuries from the Supplementary Leverage Ratio (SLR) calculation for big banks – this would drive incremental demand. Second is the rapid growth in stablecoins. Tether reported holding $120B of Treasuries to support the value of USDT.

These cross currents will complicate interpretations of the yield curve. Some time ago, I wrote about fiscal dominance – the idea that monetary policy is set to accommodate the massive debt burden of the government. I don’t think we are there yet. At least not with Powell in charge. We should all keep an eye on this.

I don’t think anyone would argue with the idea that change, in just about every measurable sense, is accelerating. The world is a very different place than it was just three months ago. The pre-COVID era seems like a lifetime ago. I mention this phenomenon almost every quarter, but that’s because I believe it is worth repeating.

Advancements in generative artificial intelligence are a massive source of change, too. I find it very interesting, and a little scary, that none of the top AI firms have mentioned diminishing marginal performance or scalability walls. The performance improvements just keep coming.

We are in the very early days of new applications and uses. I’ve been very excited about generative AI for video. If you haven’t seen some of the latest things to come out of Google’s Veo 3 or Midjourney, it’s absolutely mind blowing. It was only about a year ago that AI videos looked creepy and awkward – most models failed on rendering hands and mouths, and the physics just weren’t right. Those problems have largely been remedied. Today’s videos are virtually indistinguishable from reality.

When people worry about jobs that will get replaced by AI, I think Hollywood and the advertising industry may be the first casualties. You don’t need actors, you don’t need cameramen, you don’t need a set. Are there enough AI data centers and nVidia processors to generate all the video content that will be created? It’s unlikely.

With all the rapid change, there is more noise than ever in the system. Whether the subject is tariffs, World War III, DOGE, immigration, or even AI, the short-term market narratives are fueling volatility which in turn simply creates more opportunity for long-term investors. With our focus and experience in exploiting opportunities created by behavioral biases, there has never been a more target-rich environment.

1 The S&P 500® Index is a broad-based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. Copyright © 2025, S&P Global Market Intelligence (and its affiliates as applicable). All rights reserved. See additional information regarding S&P ratings. You cannot invest directly in an index.