Stephens Small-Mid Cap Core Growth Strategy

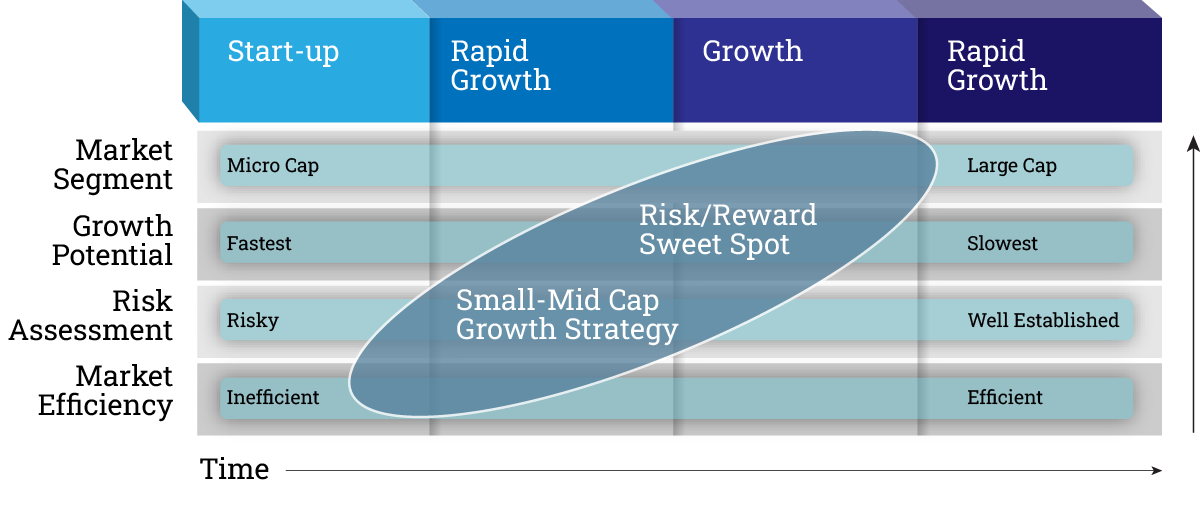

Stephens Investment Management Group, LLC is the investment adviser to the Stephens Small-Mid Cap Core Growth Strategy, a diversified approach seeking long-term capital growth by investing primarily in small and mid-cap core growth companies.

Selecting Established Growth Leaders

We select growth companies that are established growth companies that have achieved above average growth. Typically such companies have achieved this by having a defensible business model, quality management team and/or unique product opportunity in a large market.

Diversification with Growth Potential Risks

In addition, both small and mid-cap stocks can be a complement to an overall portfolio, offering strong diversification benefits while reducing capitalization concentration risk and offering the potential to maximize long-term returns.

However, investing in small or mid-cap companies involves greater risk than investing in more established companies, and the prices of small or mid company stocks may be more volatile than those of larger company stocks.

Small Cap Expertise, Mid Cap Advantage

We feel our experience in small cap issues gives us the knowledge and expertise in mid cap companies. Since the majority of mid cap companies were once small cap, we have the advantage of having closely followed many of these companies since their early stages of growth.

Engaging With Us

Engage with Stephens Investment Management for disciplined small-mid cap growth, targeting long-term capital appreciation and diversification.