Our Investment Team

We take a collaborative, team-based approach to small and mid cap growth investing—driven by rigorous research, clear catalysts, and consistent execution you can trust.

Sales, Marketing & Client Services

Operations, Legal, and Compliance

History

Founded in 2005, Stephens Investment Management Group (SIMG) builds on a seasoned investment team with deep roots in small and mid-cap growth investing, committed to aligning their interests with clients through ownership and profit-sharing.

SIMG was established in 2005 as a registered investment advisor after joining Stephens in 2004. Prior to establishing SIMG, the four senior portfolio managers were at AIM Investments (now INVESCO) and responsible for the AIM Small Cap Growth Fund as well as other small and mid-cap growth investment products. A number of our investment professionals have experience managing small and mid-cap securities since 1995 and have experienced success through many different market environments.

The four original senior members have not experienced any turnover since our inception. The five portfolio managers on the investment team are beneficiaries of an incentive plan and owners of phantom shares, which entitle them to receive a percentage of the net profits of SIMG, in addition to having a considerable portion of their personal savings invested in our strategies. We believe in investing alongside our clients.

Portfolio management, research and analysis, trading, marketing and client services are located in Houston, Texas. Legal, Compliance, Administration and marketing support are located in Little Rock, Arkansas.

Parent Organization

Founded in 1933 on a handshake and a belief in long-term value, Stephens Inc. has grown from trading Arkansas highway bonds into one of the nation's most respected private financial firms. Now in its third generation of family leadership, the firm continues to be guided by a deep commitment to integrity, personal service, and enduring client relationships.

A Little History…

In 1933, W.R. (Witt) Stephens founded Stephens Inc. to trade Arkansas Highway bonds, which were then selling as low as 10 cents on the dollar. He had been encouraged by his father, A.J. Stephens, a state legislator who insisted that Arkansas would eventually make good on the bonds.

By the time the bonds paid off at par in the early '40's, Stephens Inc. had gained a reputation for both municipal bond expertise and for providing valued financial counseling.

Since its founding, the firm has expanded in a natural but conservative evolution. Trading municipal bonds led to municipal underwriting and to the development of close relationships with institutional and individual investors, many of whom have become close and long-time friends.

In 1946, Mr. Witt Stephens' brother, Jackson T. Stephens, joined the Firm after graduation from the U.S. Naval Academy. In 1956, Jack Stephens became an equal partner with his brother and served as Chief Executive Officer of Stephens Inc. until 1986.

Jack Stephens is largely responsible for the development of the distinctive, personal style for which Stephens Inc. is known. Under his direction, Stephens Inc. entered the equity markets with emphasis on building a Corporate Finance practice, Equity Trading Department and an expanded Bond Trading Department.

In 1986, Jack's son, Warren Stephens, was named CEO of Stephens Inc. He directed the firm for nearly 40 years, strategically expanding its services over time. In January 2025, Warren Stephens announced he was passing the baton to the next generation of leadership. His sons, Miles and John Stephens, were named Co-Chief Executive Officers of Stephens Inc. His daughter, Laura Brookshire (née Stephens), was named Senior Executive Vice President and Chair of the Executive Committee, where she, alongside her brothers and the broader Stephens C-Suite play an integral role in the stewardship and continued growth of the firm. This transition marks Stephens' third era of generational leadership, in the 90+ year-old family business that was built on a handshake between two brothers.

The Stephens family has a corporate philosophy that leads to ongoing client relationships based on integrity and respect for accumulated capital. SIMG is proud to continue the tradition of personal service, responsiveness, mutual trust and expertise that the Stephens family established in 1933.

Headquartered in Little Rock, Arkansas, Stephens Investments Holdings LLC (“SIH") owns a controlling interest in SIMG. SIH is a privately held, family owned company.

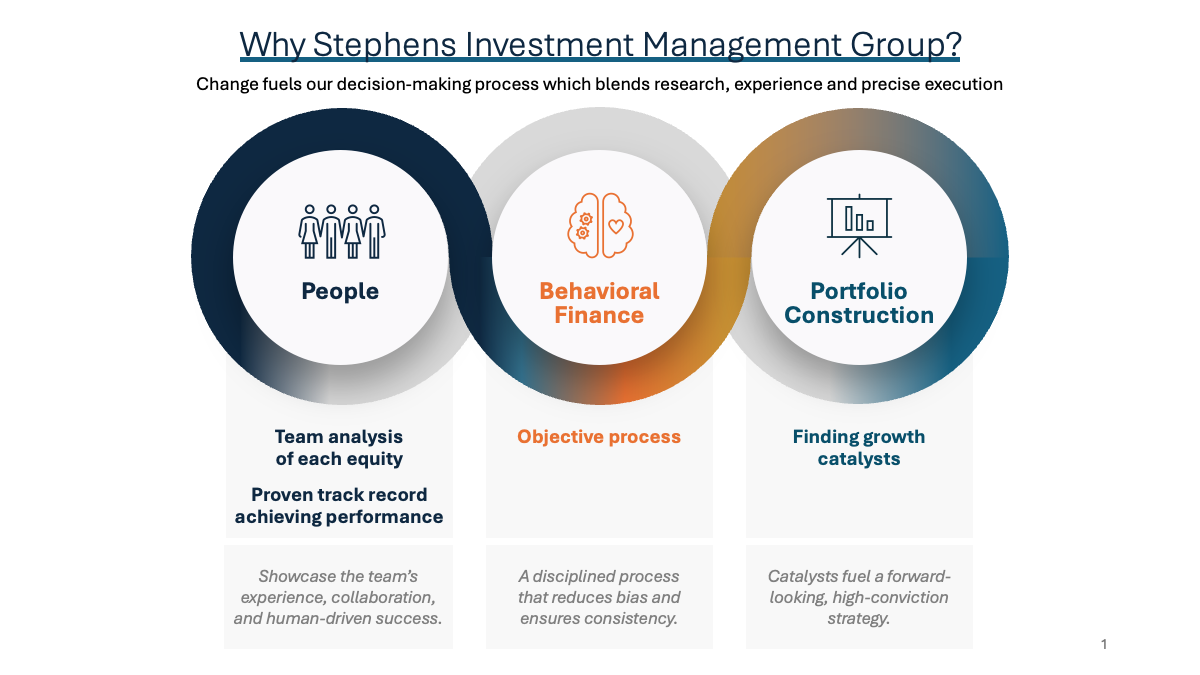

Why SIMG?

- Team analysis of each equity

- Finding growth catalysts

- Objective process

Engage With Us

See how harnessed disciplined, team-driven decisions to capture lasting value from transformational change.

713-993-4200